How would you describe the 2022 real estate year?

In 2021, you could say logistics and industrial real estate was booming and that carried on into January last year. When the war in Ukraine started, there was a moment of market reflection due to the geopolitical uncertainty and that was much more visible in the east of Europe. But then inflationary pressures really began to build up and that led to the interest rate rises and concerns among investors.

Market demand from occupiers continues to be strong and so a mismatch developed with the capital owners getting cold feet and hesitating on investments. However, although the overall ‘package’ was getting more and more expensive, the very strong tenant demand has so far continued to absorb the higher costs and yields.

What are the main challenges facing the sector and your company in 2023?

In logistics, 2023 is going to be the year of virtually zero vacancy and challenges to the industry’s capacity to be able to develop new space. We are starting to see signs of inflation stabilising and, if that continues, the interest rate environment will also stabilise. That will mean the market is better able to price transactions. Deal volume will begin to accelerate again, because there is a huge amount of capital waiting to be allocated to the industrial and logistics assets class. But investors are also waiting for the ‘right deals’ to come along and capital is generally much less willing to commit than in 2021, which was an extraordinary record year for investments from any standpoint.

Logistics rents in Poland grew by between 25% and 30% last year. But on average, they are still the lowest of any major market in Europe, which represents an amazing investment opportunity. Robert Dobrzycki

What are likely to be the chief positive influences in 2023?

Logistics will continue to lead the real estate investment pack, because it remains very attractive relative to the main alternative property sectors. There are a lot of market uncertainties around offices, retail, and even residential assets, which don’t apply to our sector because the underlying fundamentals are still so strong.

With less space being produced, vacancy rates will remain low and rental growth will continue. I think we’ll see a kind of tipping point, or perception bias, that will lead investors to transact. When the covid pandemic began in early 2020 it was all doom and gloom, but I had a strong hunch then it would be an amazing time for the logistics sector, and that was the case. I have the same intuition now and the feeling the market could jump up far more in 2023 than people were expecting at the start of the year.

Where do you see the best value and what will be the best strategy in the year ahead?

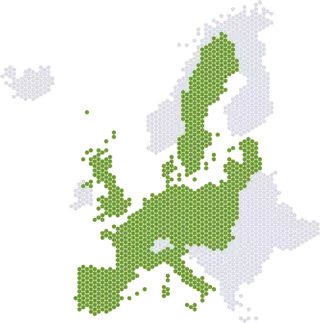

I believe a logistics market recovery in 2023 will be broad-based across continental Europe, because the same strong fundamental factors are driving all the markets in which Panattoni operates. Central and Eastern European countries may benefit more from the supply chain nearshoring trend in the short-to-medium term, but the biggest overall driver for the long term will be the continuing expansion of e-commerce. The more liquid markets in Western Europe, such as Germany and the Netherlands, could perform better for investment transactions during an economic slowdown and CEE presents opportunities to load up on high-yielding properties now ahead of the rebound when deals come roaring back. Investors also tend to underestimate the potential of CEE. Logistics rents in Poland grew by between 25% and 30% last year. But on average, they are still the lowest of any major market in Europe, which represents an amazing investment opportunity.

Looking back at 2022, what has given you the greatest inspiration for the year ahead?

I’ve been inspired by how Panattoni’s teams across Europe, but particularly in our relatively new markets in Western Europe, have stepped up to the plate and delivered for our investors and occupiers. Germany is a great example. We’ve leapt to being the number one logistics and industrial developer currently, from being ranked 18 when we entered the German market in 2014. We could only achieve that through Panattoni’s ‘special sauce’ of teamwork, transparency and fairness in our dealings.